In 2012, most important sources of domestic energy consumption in Tanzania by far were biofuels and waste such as firewood: 85 % of consumption. Through its National Energy Policy 2015, the Government of Tanzania promotes the domestic use of petroleum resource including natural gas to accelerate socio-economic transformation. It intends explicitly that petroleum resource is to benefit all Tanzanians.

The Petroleum Act (2015) provides for establishment and operationalization of Petroleum Upstream Regulatory Authority (PURA) to effectively and efficiently manage petroleum upstream operations. Conversely, the Energy and Water Utilities Regulatory Authority (EWURA) is responsible for regulating the downstream petroleum and natural gas subsector, as well as electricity and water sub-sectors. The policy among others, gives guidance on establishment of upstream regulator to effectively and efficiently manage petroleum upstream operations. The Tanzanian Petroleum Development Company (TPDC) is the official National Oil Company. It also has a major role to regulate upstream, midstream and downstream operations. The Oil and Gas Revenues Management Act was passed in July 2015 sets out a comprehensive revenue management framework, including the establishment of an oil and gas fund and a number of fiscal rules related to both oil and gas revenues and overall public finances.

The discovery of large deposits of natural gas off the coast of Tanzania has led to expectations that the sector could transform the economy and drive human development, providing hope for 12 million Tanzanians living in poverty. It could have an important contributor to government revenue via export of liquified natural gas (LNG) and also to improve the country’s power generation capacity through some of the gas being supplied to the domestic market.

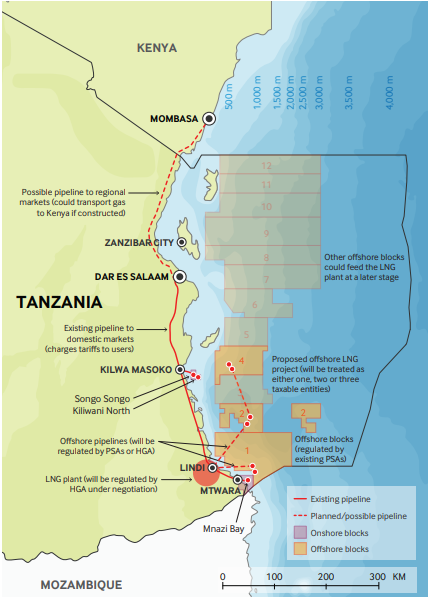

Tanzania has been exploring for natural gas for more than 50 years. The first natural gas discovery in Tanzania was made in 1974 on the Songo Songo Island (Lindi Region) followed by a second discovery at the Mnazi Bay (Mtwara Region) in 1982. The natural gas from Songo Songo was first commercialized in 2004 and the natural gas from Mnazi Bay in 2006. The commercialization of the two discoveries propelled further gas exploration both onshore and offshore. Tanzania’s gas sector is comprised of numerous projects that are of various scales and stages of development, and are subject to different regulatory frameworks.

The potential LNG project comprises three offshore blocks, a network of offshore pipelines and an onshore LNG plant. Offshore blocks 1,2,4 hold the greatest majority of Tanzania’s discovered natural gas. Cumulatively the blocks are estimated to contain proven and probable reserves of 27 trillion cubic feet. Statoil and Shell hold the exploration and productions rights to the three offshore blocks (with ExxonMobil, Ophir energy and Pavilion Energy holding minority interests). The onshore blocks supply the domestic market through a network of onshore pipelines. The primary part of this network is the Mtwara to Dar es Salaam pipeline, in which the government holds a majority share.

Map of Natural Gas Assets in Tanzania

Forecast LNG Growth

An African Development Bank 2015 report estimates that annual revenue could average between $1 billion and $2.2 billion in the first 10 years of production of offshore gas, beginning in 2021. Sale prices have significantly dipped since this time. Asian LNG price is indexed to the oil price and therefore much of the price decrease since 2014 can be attributed to the lower oil price. Long term forecasts are also coloured by expected global responses to climate change and transition to alternative energy sources.

Investment in LNG project is very uncertain and will largely depend on the long-term LNG price companies expect. There is a strong possibility the project will not go ahead. If it does the government revenues are unlikely to be transformative.

One of the most important policy implications of uncertain and likely modest revenues is that the government should not base its public finance plans—and in particular should be careful not to build up excessive debt—on the expectation of a gas windfall. Doing so would put Tanzania at risk of a common mistake that has plagued many countries that have made large discoveries, a phenomenon we called the “resource curse.”

Reading

Friedrich-Ebert-Stiftung Tanzania and OpenOil (2015) Tanzania Oil and Gas Almanac

Ministry of Energy and Minerals National Energy Policy 2015

National Resource Governance Institute Sept 2017 Briefing Unlocking Potential: Managing Tanzania’s Gas Revenues